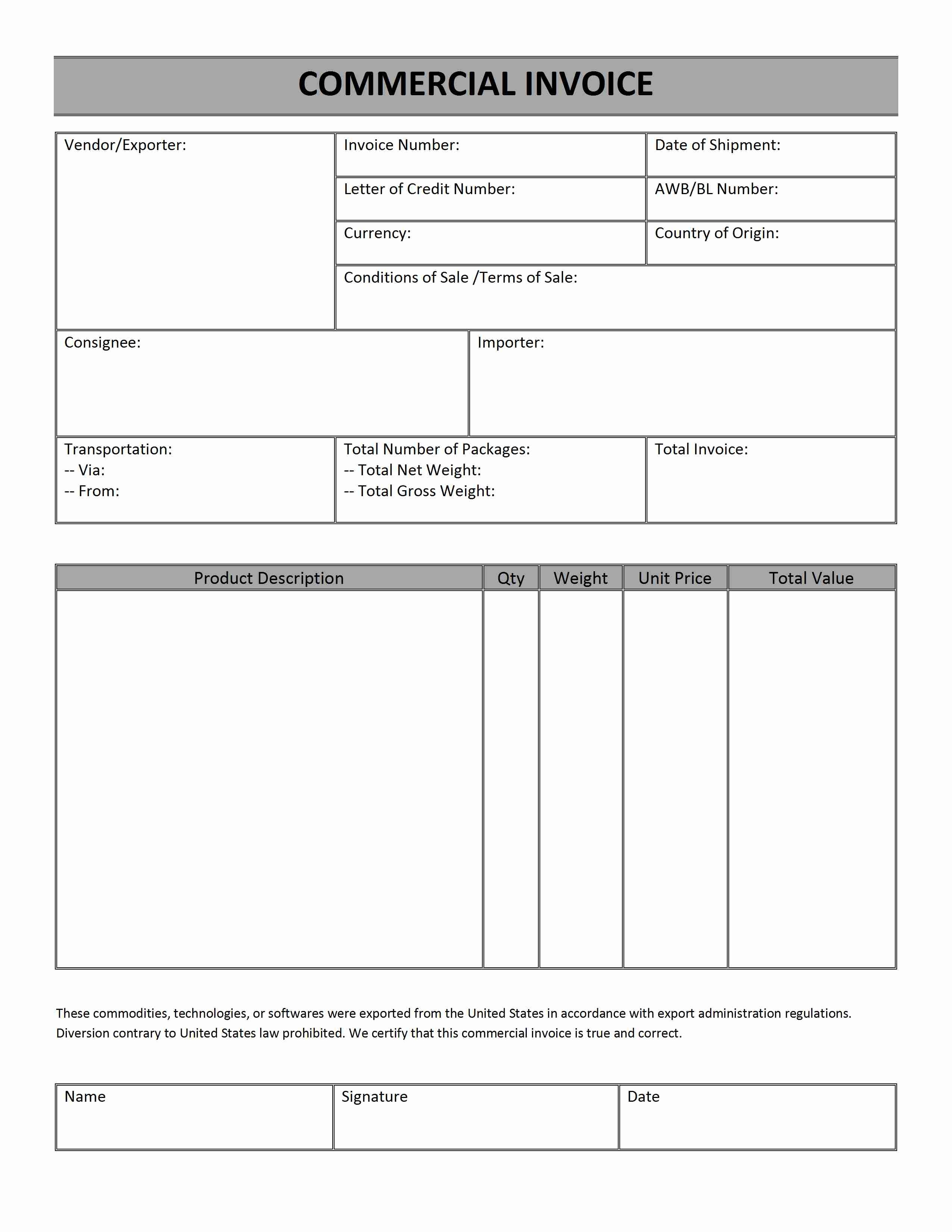

Royalty Payments has the meaning set forth in Section 4.02(a). Proper Invoice means a written request for Payment that is submitted by a Contractor setting forth the description, price or cost, and quantity of goods, property or services delivered or rendered, in such form, and supported by such other substantiating documentation, as NYSERDA may reasonably require, including but not limited to any requirements set forth in Exhibits A or B to this Agreement and addressed to NYSERDA’s Controller, marked “Attention: Accounts Payable,” at the Designated Payment Office. Royalty Payment shall have the meaning set forth in Section 9.4(a). Valid Invoice means an invoice containing the detailed information set out in clause C2 (Payment and VAT).ĭebit Payment means a particular transaction where a debit is made. Gross receipts tax means any gross receipts, sales, use, excise, value added or any similar tax. At the Agency’s discretion, claims may be submitted on an original invoice from the Contractor or may be submitted on a claim form acceptable to the Agency, such as a General Accounting Expenditure (GAX) form. Invoice means a Contractor’s claim for payment. Tax Invoice means the document as required by Section 20 of the VAT Act, as may be amended from time to time

0 kommentar(er)

0 kommentar(er)